Liability Insurance Company: Providing Comprehensive Coverage for Your Business

You know how important it is to safeguard your organization against the numerous hazards associated with doing business in today’s environment. Liability lawsuits are one of the main hazards that might jeopardize your company’s profitability and survival. Liability insurance company can be useful in situations like these. You may relax knowing that your firm is safeguarded against a variety of potential claims by purchasing comprehensive liability insurance coverage from a reliable liability insurance company.

Alltin.net will discuss the significance of liability insurance as well as the various of liability insurance, the specifics of coverage, the advantages of liability insurance, and how to select the best liability insurance company for your organization.

Importance of Liability Insurance

Liability insurance is a type of insurance that protects individuals and businesses from financial loss resulting from legal claims or lawsuits filed against them. These claims may arise due to negligence, personal injury, property damage, or other forms of liability.

The importance of liability insurance for businesses cannot be overstated. Without liability insurance, a single lawsuit or legal claim could result in significant financial loss that could put your business in jeopardy. Liability insurance provides the financial protection you need to cover the costs associated with legal defense, settlement, and judgment.

Types of Liability Insurance

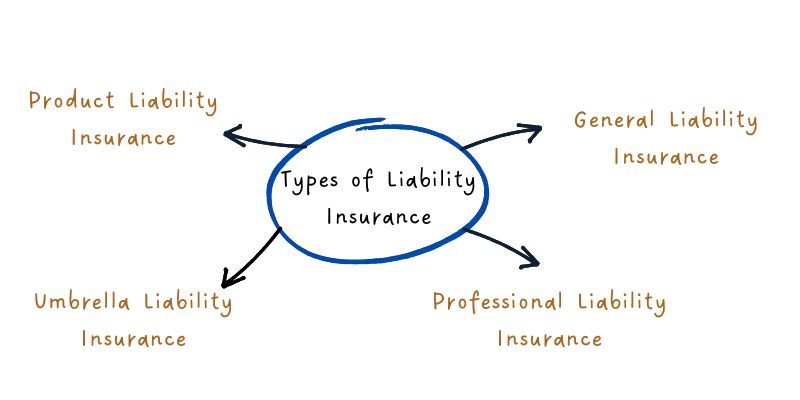

There are several types of liability insurance policies available, each designed to protect businesses from different forms of liability claims. Here are some of the most common types of liability insurance policies:

1. General Liability Insurance

General liability insurance is the most common type of liability insurance for businesses. It provides coverage for bodily injury, property damage, and personal injury claims. It also covers legal defense costs and settlements or judgments that may result from covered claims.

2. Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, provides coverage for businesses that provide professional services, such as lawyers, accountants, and doctors. It covers claims related to errors, negligence, or malpractice in the performance of professional services.

3. Product Liability Insurance

Product liability insurance provides coverage for businesses that manufacture, distribute, or sell products. It covers claims related to product defects, design flaws, or other product-related issues that may result in bodily injury, property damage, or other forms of liability.

4. Umbrella Liability Insurance

Umbrella liability insurance provides additional liability coverage that extends beyond the limits of your primary liability insurance policies. It provides additional protection against catastrophic liability claims that could exceed your primary coverage limits.

Coverage Details

The specific details of your liability insurance coverage will depend on the type of policy you choose and the coverage limits you select. However, here are some of the common areas of coverage provided by liability insurance policies:

1. Bodily Injury

Bodily injury coverage provides protection against claims that arise from physical harm or injury to a person. This could include medical expenses, lost wages, and pain and suffering.

2. Property Damage

Property damage coverage provides protection against claims that arise from damage to someone else’s property. This could include damage to buildings, vehicles, or other property.

3. Personal Injury

Personal injury coverage provides protection against claims that arise from non-physical harm, such as libel, slander, or defamation.

4. Legal Defense

Legal defense coverage provides protection against the costs of legal defense, including attorney fees, court costs, and other legal expenses.

5. Settlements or Judgments

Settlement or judgment coverage provides protection against the costs of settling a claim or paying a judgment that may result from a covered claim.

Benefits of Liability Insurance

The benefits of liability insurance company for businesses are many. Here are some of the key benefits:

1. Protection from Financial Loss

One of the primary benefits of liability insurance is protection from financial loss resulting from legal claims or lawsuits. Without liability insurance, a single claim or lawsuit could result in significant financial loss that could put your business in jeopardy. Liability insurance provides the financial protection you need to cover the costs associated with legal defense, settlement, and judgment.

2. Protection of Company Reputation

A lawsuit or legal claim can damage your company’s reputation, regardless of whether you are found liable or not. Liability insurance provides the means to defend against such claims and protect your company’s reputation in the process.

3. Peace of Mind for Business Owners

Knowing that your business is protected against liability claims can give you peace of mind as a business owner. This allows you to focus on running and growing your business without worrying about the financial risks associated with potential legal claims.

4. Legal Representation in Case of a Lawsuit

Liability insurance policies provide access to legal representation in case of a lawsuit. This can be invaluable in protecting your business interests and ensuring that your legal rights are protected.

Choosing a Liability Insurance Company

When it comes to choosing a liability insurance company, there are several factors to consider. Here are some of the most important factors:

1. Reputation and Financial Stability of the Company

Choose a liability insurance company with a strong reputation for reliability and financial stability. This ensures that the company will be able to meet its obligations in the event of a claim or lawsuit.

2. Coverage and Limits

Make sure to choose a liability insurance company that offers the specific types of coverage your business needs. Also, consider the coverage limits and make sure they are sufficient to protect your business against potential liabilities.

3. Pricing and Deductibles

Compare pricing and deductibles from different liability insurance companies to ensure you are getting the best value for your money. Keep in mind that the cheapest option may not always be the best choice.

4. Customer Service

Choose a liability insurance company that provides excellent customer service and is responsive to your needs. This can be especially important in the event of a claim or lawsuit, where you will want to be able to get quick and efficient assistance.

5. Expertise and Industry Knowledge

Choose a liability insurance company that has expertise and knowledge of your industry. This can be especially important for businesses that operate in high-risk industries, where specialized knowledge and expertise may be necessary to provide adequate coverage.

Conclusion

The risk management plan of every company must include liability insurance. You may feel secure knowing that your firm is safeguarded against a variety of potential claims by purchasing comprehensive liability insurance coverage from an established liability insurance company. Think carefully about the many liability insurance options, the specifics of coverage, the advantages, and how to pick the best liability insurance provider for your organization. You can concentrate on managing and expanding your company without having to worry about the potential financial risks brought on by liability claims if you have the appropriate liability insurance coverage.