Melio- The Best for Processing Accounts Payable for Small Business

For efficient vendor and supplier payments, your Processing Accounts Payable for Small Business is essential. Your organization may concentrate on maximizing the benefits of connections with a variety of business partners when debts and invoices are paid on time. But there are a wide variety of paid software applications on the market. For your firm to grow and compete with others, you must use the best tool for the job. Let’s follow us to find out “Melio: The Best for Processing Accounts Payable for Small Business” right now!

What is Accounts Payable Software?

Accounts Payable Software assists you in keeping track of your invoices, which is critical to the successful management of accounts payable and your business in general. The most effective options automate the frequently manual account billing process and include time-saving features such as invoice scanning and accounting software integration.

AP is a catch-all name for specialized software that performs particular tasks and falls within the AP category. For instance, AP software solutions include AP automation solutions like Tipalti as well as enterprise resource management (ERP) systems like NetSuite.

In order to process, document, and pay reduced vendor bills, accounts payable teams use accounts payable software systems. The greatest automation systems are intended to decrease manual work by up to 80%. Accounts payable software may need manual chores like data input and matching paper bills with purchase requisitions and receivers.

Why Melio is The Best for Processing Accounts Payable for Small Business?

What is Melio?

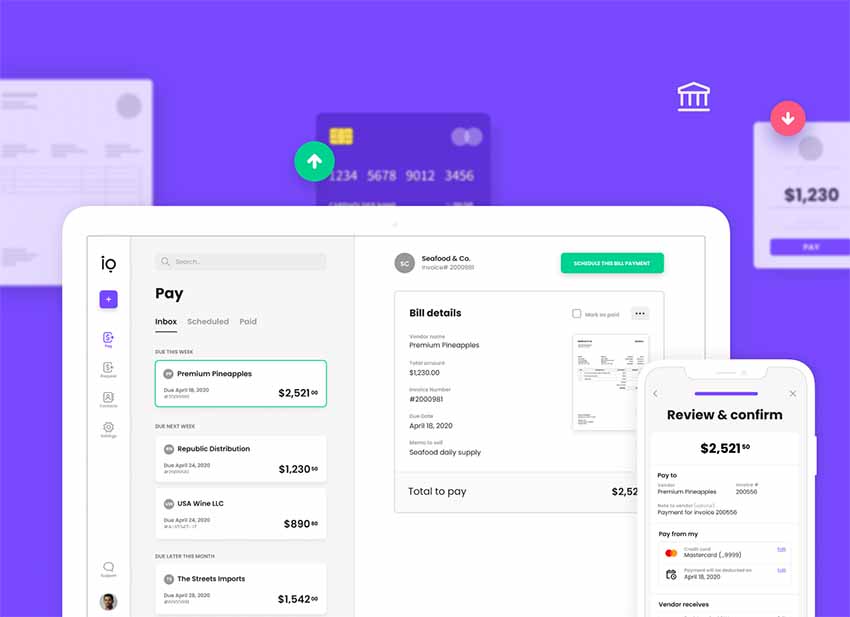

Melio is an online account payment solution that allows businesses to conveniently make bank transfers, debit and credit cards. Melio was created for small business owners to make making payments as simple as possible. With just a few clicks, small businesses can access their accounts from any device such as a computer or mobile device and make payments anywhere, anytime.

You may have your consumers pay you via Melio in addition to paying others. One feature of Melio is their free personalized pay-page called Melio.me, which lets a company ask for and get payments from clients via credit cards or bank transfers.

Benefits of Melio

Effortless Use

The platform’s simplicity and ease of use are ultimately the main advantages and competitive advantages that Melio provides. This program simplifies the lives of its users in a variety of ways while also being easy to use. Let’s examine each individually:

Use Is Free

As a small business owner who is constantly worried about time and money, you want to know the price before weighing all of your options for a new tool for your company. Wonderful news: Melio is largely uninvolved! They don’t impose any fees for using the platform for a trial period, for signing up, for adding new suppliers or clients, for exceeding a specific threshold for invoices or transactions, or even for transactions in general.

The sole expense associated with utilizing Melio is a 2.9% fee applied to all credit card transactions, including both customer and bill payment transactions. You may start without paying anything upfront, and there aren’t any more economical options available on the market right now, so consider that box ticked.

Easy and practical functionality

The creators of Melio have created a platform exclusively for small companies and the payments they must make at a time when more and more consumers are choosing online shopping over in-person interactions.

The company’s goal has been to ease the transition of small businesses in the US into the digital era by developing a system that lets them replace outdated practices like paper invoices, snail mail, and money transfers that may take several days to clear and make life more difficult for business owners in the modern online environment.

You may easily and digitally send and receive money with Melio. It’s simple to add bills and pay them using credit, debit, or bank transfers. You may even be proactive and set up a payment plan for a certain expense.

The fact that Melio is aware that not all merchants favor the same type of payment and that their preferences might not always coincide with yours is perhaps the most significant factor. The issue is resolved by Melio. Say your vendor requests payment by ACH transfer, but you are short on cash and must use credit. Melio has thought about this and come up with a solution.

How much does Processing Accounts Payable for Small Business cost?

The monthly cost of Processing Accounts Payable for Small Business can range from $0 to $150 or more. Basic plans are a wonderful place to start and typically cost between $0 and $40 per month. A small firm will be able to classify income and costs, send invoices, and create financial reports with the help of a basic plan. Most software is scalable as a firm expands, and the strategy may be quickly changed to accommodate new business requirements. The more comprehensive plans provide businesses the ability to manage payroll, create more specialized financial reports, track inventory, and select from a wider range of invoicing alternatives.

Conclusion

In conclusion, Melio is without a doubt the leader in the field of digital payments. One of the largest shifts in the last two years has been the world’s continued drive toward the digital era, and this trend will only continue. Small business owners must use technology to increase their effectiveness in the digital era, thus this is very relevant to them.